PROPOSAL 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

The Audit Committee of our Board of Directors has appointed PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 30, 2010.February 2, 2013. We are asking stockholders to ratify this appointment. Representatives of PwC will attend the 2009 Annual Meeting, where they will have the opportunity to make a statement if they wish to do so and will be available to answer questions from the stockholders.

Your Board of Directors unanimously recommends a vote FOR Proposal 3,2, Ratification of Appointment of Independent Registered Public Accounting Firm.

PROPOSAL 3

APPROVAL OF MATERIAL TERMS OF EXECUTIVE OFFICER PERFORMANCE GOALS

UNDER CASH INCENTIVE PLANS

We are seeking approval of the material terms of performance goals of our cash incentive plans, MIP and LRPIP, as they apply to our executive officers.

Section 162(m) of the Internal Revenue Code generally provides that compensation provided to a publicly held corporation’s CEO or any of its three most highly paid named executive officers (other than its CEO or CFO) is not deductible by the corporation for U.S. income tax purposes for any taxable year to the extent it exceeds $1 million. This limitation does not apply to compensation that qualifies as exempt performance-based compensation by meeting certain requirements under Section 162(m), including the requirement that the material terms of the related performance goals be disclosed to and approved by shareholders every five years. Under Section 162(m), the material terms include the class of eligible employees, a description of the business criteria on which the performance goals may be based and the maximum amount that can be paid to any participant for a specified period. Although shareholder approval is one of the requirements for exemption under Section 162(m), even with shareholder approval there can be no guarantee that compensation will be treated as exempt performance-based compensation under Section 162(m).

Our stockholders last approved the material terms of MIP and LRPIP performance goals at our Annual Meeting in 2007. Those terms will continue to apply to outstanding MIP and LRPIP awards. The ECC amended MIP and LRPIP in April 2012 to expand the available business criteria on which future performance goals may be based and to increase the award maximum per participant for future awards, as described below.

We now seek approval of the material terms of MIP and LRPIP performance goals to enable us to provide exempt performance-based compensation under these programs. As discussed above in Tax and Accounting Considerations in “Compensation Discussion and Analysis,” notwithstanding stockholder approval of these performance goals, the ECC will continue to have authority to provide compensation that is not exempt from the limits on deductibility under Section 162(m).

Overview. MIP and LRPIP are both administered by the ECC, which consists solely of outside directors. Awards consist of individual award opportunities and related performance targets for a specified performance period, typically one year for MIP and three years for LRPIP. For awards intended to qualify as exempt performance-based compensation under Section 162(m), objectively determinable performance goals and payout formulas are pre-established by the ECC for each performance period. After completion of the performance period, the ECC reviews and certifies performance results and the payout for the awards. Once award terms have been established, the Section 162(m) exemption rules generally prohibit discretionary adjustments, other than

adjustments to reduce any amount payable under the award. Amounts payable under the amended MIP and LRPIP performance goals described in this proposal will be based on future award opportunities and performance and are not determinable at this time. For a description of prior MIP and LRPIP awards for our named executive officers, see the “Compensation Discussion and Analysis” and related compensation tables, above.

Eligibility and Participation. Awards under MIP and LRPIP may be granted to executive officers selected from time to time by the ECC and to other key employees of TJX and its subsidiaries selected from time to time by the ECC or its authorized delegate. Currently, approximately 3,400 Associates participate in these plans, including our executive officers.

Business Criteria for MIP and LRPIP Performance Goals. For each award granted under MIP and LRPIP that is intended to qualify as exempt performance-based compensation, the performance goals set by the ECC will be one or more objectively determinable measures of performance relating to any one or any combination of the following business criteria (measured on an absolute basis or relative to one or more comparators, including one or more companies or indices, and determined on a consolidated, divisional, line of business, project, geographical or area of executive’s responsibilities basis, or any combination thereof):

Sales, revenues, or comparable store sales;

Assets, inventory levels, inventory turns, working capital, cash flow or expenses;

Earnings, profit, income, losses or margins, before or after deduction for all or any portion of interest, taxes, depreciation, amortization, rent, or such other items as the ECC may determine at the time the performance goals are pre-established, whether or not on a continuing operations and aggregate or per share basis, basic or diluted, before or after dividends;

Return on investment, capital, equity, assets, sales or revenues, or economic value added models or equivalent metrics;

Market share, store openings or closings, customer service or satisfaction levels, or employee recruiting, retention or diversity;

Stock price, dividends, or total shareholder return, or credit ratings; or

Strategic plan implementations.

The ECC may provide for automatic adjustments (in measures of achievement, amounts payable, or other award terms) to reflect objectively determinable events (for example, acquisitions, divestitures, extraordinary items, other unusual or non-recurring items and/or changes in accounting principles) that may affect the business criteria, any such adjustment to be established and administered in a manner consistent with the requirements for exempt performance-based compensation under Section 162(m).

Maximum Awards. Under the amended plans, the maximum amount payable to any participant under MIP for any fiscal year, and the maximum amount payable to any participant under LRPIP for one or more performance cycles beginning in a single fiscal year, is $5 million, increased by 5% per year starting with our fiscal year ending February 1, 2014 (fiscal 2014).

Performance-based awards under our MIP and LRPIP are an important part of our compensation system. We rely on them to attract and retain our management. In order to preserve our ability to make tax deductible awards under MIP and LRPIP, we are seeking your approval of the material terms of the performance goals described above.

Your Board of Directors unanimously recommends that you vote FOR Proposal 3, Approval of Material Terms of Executive Officer Performance Goals under Cash Incentive Plans.

PROPOSAL 4

ADVISORY APPROVAL OF EXECUTIVE COMPENSATION

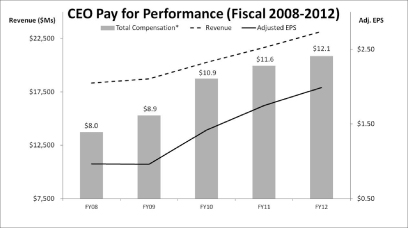

The Compensation Discussion and Analysis beginning on page 15 of this Proxy Statement describes our executive compensation program and the compensation of our named executive officers for fiscal 2012. The Board of Directors is asking stockholders to cast a non-binding, advisory vote indicating their approval of that compensation by voting FOR the following resolution:

“RESOLVED, that the stockholders of The TJX Companies, Inc. APPROVE, on an advisory basis, the compensation paid to its named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.”

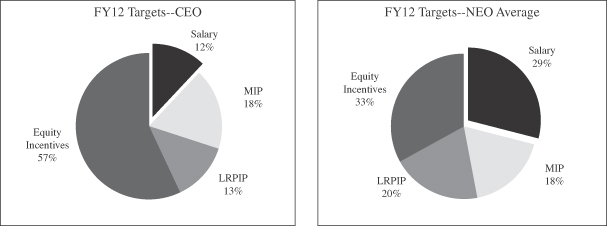

As described in more detail in the Compensation Discussion and Analysis, we have a total compensation approach focused on performance-based incentive compensation that seeks to:

attract and retain very talented individuals in the highly competitive retail environment, maintaining an extremely high talent level in our company and providing for succession broadly across our management,

reward objectively determinable achievement of the short- and long-term financial objectives reflected in our business plans, and

enhance shareholder value by directly aligning the interests of our executives and stockholders.

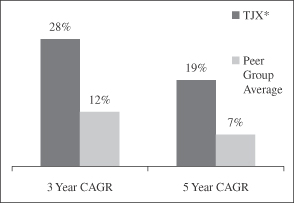

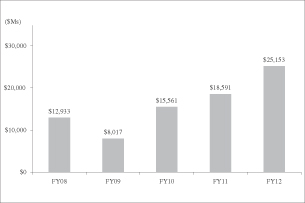

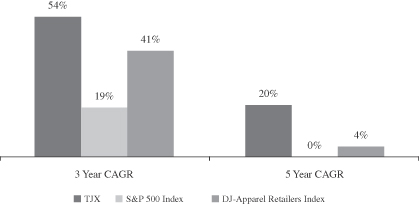

The Board is asking stockholders to support this proposal. We believe TJX’s performance demonstrates the effectiveness of our compensation program. We received a strong supporting vote last year (more than 97% of votes cast) expressing support for our compensation policies and practices and believe our program continues to be effective. We continue to focus on pay for performance in our compensation program, as described in the Compensation Discussion and Analysis, which we encourage you to review. Although the vote we are asking you to cast is non-binding, the ECC and the Board value the views of our stockholders. As with the results last year, the Board and Executive Compensation Committee will consider the outcome of this vote when determining future compensation arrangements for our named executive officers. Our Board of Directors currently intends to conduct an annual advisory stockholder vote on executive compensation each year until the next advisory vote on the frequency of our say on pay advisory votes is held, which will be no later than the annual meeting of the stockholders in 2017.

Your Board of Directors unanimously recommends a vote FOR Proposal 4, Advisory Approval of Executive Compensation.

VOTING REQUIREMENTS AND PROXIES

The nominees receiving a majority of votes properly cast at the meeting will be elected directors. Under our Corporate Governance Principles, any nominee for director must provide the Secretary of the Company an irrevocable contingent resignation prior to the distribution of proxy solicitation materials for the meeting at which such director is expected to be nominated to stand for election. Such resignation will be effective only if such director fails to receive a majority of the votes cast in an uncontested election, as provided in the by-laws, and the Board accepts such resignation. All other proposals require the approval of the majority of votes properly cast.

If you vote your shares by mail, telephone or Internet, your shares will be voted in accordance with your directions. If you do not indicate specific choices when you vote by mail, telephone or Internet, your shares will be voted for the election of the director nominees for approval of amendments to and performance terms of the Stock Incentive Plan, and(Proposal 1), for the ratification of the appointment of the independent registered public accounting firm.firm (Proposal 2), for the approval of material terms of executive officer performance goals under cash incentive plans (Proposal 3) and for the advisory approval of the company’s executive compensation (Proposal 4). The persons named as proxies will also be able to vote your shares at postponed or adjourned meetings. If any nominee should become unavailable, your shares will be voted for another nominee selected by the Board or for only the remaining nominees. Brokers are not permitted to vote your shares with respect to approval of amendments to and performance termson any matter other than the ratification of the Stock Incentive Planindependent registered public accounting firm

(Proposal 2) without instructionsinstruction from you. If your shares are held in the name of a broker or nominee and you do not instruct the broker or nominee how to vote your shares with respect to the approvalelection of amendments to and performance terms of the Stock Incentive Plandirectors or Proposals 3 or 4, or if you abstain or withhold authority to vote on any matter, your shares will not be counted as having been voted on that matter, but will be counted as in attendance at the meeting for purposes of a quorum.

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS

A stockholder who intends to present a proposal at the 20102013 Annual Meeting of Stockholders and who wishes the proposal to be included in theour proxy materials for that meeting must submit the proposal in writing to us so that we receive it no later than December 28, 2009.

2012. A stockholder who intends to present a proposal at the 20102013 Annual Meeting of Stockholders but does not wish the proposal to be included in theour proxy materials for that meeting must provide written notice of the proposal to us notno earlier than February 13, 2013 and no later than March 4, 2010.15, 2013. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements. Our by-laws, which are available atwww.tjx.com, describe the requirements for submitting proposals at the Annual Meeting. A stockholder who wishes to nominate a director at the 20102013 Annual Meeting must notify us in writing no earlier than February 2, 201013, 2013 and no later than March 4, 2010.15, 2013. The notice must be given in the manner and must include the information and representations required by our by-laws.

42

THE TJX COMPANIES, INC.

STOCK INCENTIVE PLAN

(2009 Restatement)

SECTION 1.NAME; EFFECTIVE DATE; GENERAL PURPOSE

The nameAfter the tollbooth, bear left on the exit ramp across an overpass and onto Route 30 / Cochituate Road. At the second set of

the plan islights, turn left into The TJX Companies, Inc.

Stock Incentive Plan (the “Plan”)facility.From Logan International Airport (From the East)

Leaving the Airport, follow the signs for the Massachusetts Turnpike West (I-90W). The Plan is an amendment and restatement of The TJX Companies, Inc. Stock Incentive Plan as most recently previously amended in 2006. The provisions ofFollow the Plan as herein amended and restated shall applyMassachusetts Turnpike West for approximately 20 miles to Awards made after January 31, 2009 (the “Adoption Date”), except thatexit 13 (Framingham/Natick). Follow the definition of “Change of Control” as set forth herein shall apply to all Awards outstandingdirections above for“From Exit 13 on the Adoption Date andMassachusetts Turnpike.”

From the clarifications and related rules set forth herein that are relatedWest

Take Massachusetts Turnpike East (I-90E) to Section 409A ofexit 13 (Framingham/Natick). Follow the Code shall apply effective as of January 1, 2008.

The purpose ofdirections above for“From Exit 13 on the Plan isMassachusetts Turnpike.”From the North

Take I-95 South to secureexit 25 (Massachusetts Turnpike I-90). Take the Massachusetts Turnpike West (I-90W) approximately 6.5 miles to exit 13 (Framingham/Natick). Follow the directions above for The “From Exit 13 on the Massachusetts Turnpike.”

From the South

Take I-95 North to exit 25 (Massachusetts Turnpike). Take the Massachusetts Turnpike West (I-90W) approximately 6.5 miles to exit 13 (Framingham/Natick). Follow the directions above for“From Exit 13 on the Massachusetts Turnpike.”

Parking

TJX Companies, Inc. (the “Company”) and its stockholdersoffers free parking. Follow the benefit of the incentives inherent in stock ownership and the receipt of incentive awards by selected key employees and directors of the Company and its Subsidiaries who contribute to and will be responsible for its continued long term growth. The Plan is intended to motivate such individuals to enhance the long-term value of the Company by providing an opportunity for capital appreciation and to recognize services that contribute materiallyparking lot directory signage to the successvisitor parking areas.

Building Entrance

Enter the building through the Northeast Entrance (facing the Massachusetts Turnpike (I-90)).

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

We encourage you to take advantage of the Company. Capitalized terms used in the Plan shall have the meaning set forth in Section 14.

SECTION 2.PLAN ADMINISTRATION

The Plan shall be administered by the Executive Compensation Committee of the BoardInternet or

such other committee of the Board as the Board may from time to time determine (the “Committee”). The Committee shall consist of not fewer than two directors, each of whom is bothtelephone voting.Both are available 24 hours a Non-Employee Directorday, 7 days a week.

Internet and an Outside Director. If at any time the Committee shall include one or more members whotelephone voting are not Non-Employee Directors or Outside Directors, a subcommittee consisting solely of two or more individuals who are both Non-Employee Directors and Outside Directors shall constitute the Committee for purposes of the immediately preceding sentence. If at any time no Committee shall be in office, the functions of the Committee shall be exercised by the Board.

The Committee shall have the power and authority to: grant Awards consistent with the terms of the Plan, including the power and authority to select from among those eligible the persons to whom Awards may from time to time be granted; determine the time or times of grant of any Awards; to determine the number of shares to be covered by any Award; determine the terms and conditions of any Award; adopt such rules, guidelines and practices for administration of the Plan and for its own acts and proceedings as it shall deem advisable; interpret the terms and provisions of the Plan and any Award; prescribe such forms and agreements as it deems advisable in connection with any Award; make all determinations it deems advisable for the administration of the Plan; decide all disputes arising in connection with the Plan; and otherwise

-2-

supervise the administration of the Plan. All decisions and interpretations of the Committee shall be binding on all persons, including the Company and Participants.

SECTION 3.SHARES ISSUABLE UNDER THE PLAN; MERGERS; SUBSTITUTION.

(a) Shares Issuable. The maximum number of shares of Stock (“Share Limit”) that may be issued under Awards shall be the sum of (i) 28,000,000 plus (ii) the number of shares of Stock subject to Awards outstanding as of the Adoption Date. For the avoidance of doubt, if a New Award is forfeited, expires, or is satisfied without the issuance of Stock, the shares of Stock subject to such New Award shall not be treated as issued for purposes of the preceding sentence. Each share issued under a New Award that is a Stock Option or SAR shall reduce the Share Limit by one (1) share, and each share of Stock issued under any other New Award (unless reacquired by the Companyavailable through forfeiture) shall reduce the Share Limit by one and thirteen one-hundredths (1.13) shares. Subject to the Share Limit, no more than 27,500,000 shares of Stock in the aggregate may be issued pursuant to NSOs, and no more than 27,500,000 shares of Stock (less the number of shares issued pursuant to NSOs) in the aggregate may be issued pursuant to the exercise of ISOs. The number of shares of Stock subject to each of Stock Options, SARs and Performance Awards that may be awarded to any Participant during any consecutive three-year period commencing after the Adoption Date shall be limited to 8,000,000 shares each. Shares issued under the Plan may be authorized but unissued shares or shares reacquired by the Company. The Company shall appropriately reserve shares in connection with the grant of Awards to reflect the limitations set forth above.

(b) Stock Dividends, Mergers, etc. In the event of a stock dividend, stock split, reverse stock split or similar change in capitalization, or extraordinary dividend or distribution or restructuring transaction affecting the Stock, the Committee shall make appropriate adjustments in the number and kind of shares of stock or securities on which Awards may thereafter be granted, including the limits described in Section 3(a) and Section 7(c), and shall make such adjustments in the number and kind of shares remaining subject to outstanding Awards, and the option or purchase price in respect of such shares as it may deem appropriate with a view toward preserving the value of outstanding awards. In the event of any merger, consolidation, dissolution or liquidation of the Company, the Committee in its sole discretion may, as to any outstanding Awards, make such substitution or adjustment in the aggregate number of shares reserved for issuance under the Plan and in the number and purchase price (if any) of shares subject to such Awards as it may determine, or accelerate, amend or terminate such Awards upon such terms and conditions as it shall provide (which, in the case of the termination of the vested portion of any Award, shall require payment or other consideration which the Committee deems equitable in the circumstances), subject, however, to the provisions of Section 12.

(c) Substitute Awards. The Company may grant Awards under the Plan in conversion, replacement or adjustment of outstanding options or other equity-based compensation awards held by employees of another corporation who become employees or Eligible Directors of the Company or a Subsidiary as described in the first sentence of Section 4 as the result of a merger or consolidation of the employing corporation or an affiliate with the Company or a Subsidiary or the acquisition by the Company or a Subsidiary of stock of the employing corporation or an

-3-

affiliate. The Committee may direct that the converted, replacement or adjusted awards be granted on such terms and conditions as the Committee considers appropriate in the circumstances to reflect the transaction. The shares which may be delivered under such substitute Awards shall be in addition to the limitations set forth in Section 3(a)11:59 PM Eastern Time on the number of shares available for issuance under Awards, and such substitute Awards shall not be subject to the per-Participant Award limits described in Section 3(a).

SECTION 4.ELIGIBILITY.

Participants in the Plan will be (i) such full or part time officers and other key employees of the Company and its Subsidiaries who are selected from time to time by the Committee in its sole discretion, and (ii) Eligible Directors. Persons who are not employees of the Company or a subsidiary (within the meaning of Section 424 of the Code) shall not be eligible to receive grants of ISOs.

SECTION 5.DURATION OF AWARDS; TERM OF PLAN.

(a) Duration of Awards. Subject to Sections 13(a) and 13(e) below, no Stock Option or SAR may remain exercisable beyond 10 years from the grant date, and no other Award shall have a vesting or restriction period that extends beyond 10 years from the grant date, except that deferrals elected by Participants of the receipt of Stock or other benefits under the Plan may extend beyond such date.

(b) Latest Grant Date. No Award shall be granted after June 2, 2019, but then outstanding Awards may extend beyond such date.

SECTION 6.STOCK OPTIONS; SARs.

Any Stock Option or SAR granted under the Plan shall be in such form as the Committee may from time to time approve. Stock Options granted under the Plan may be either ISOs or NSOs. Any Stock Option that is not expressly designated as an ISO at time of grant shall be deemed to have been expressly designated at time of grant as an NSO. Anything in the Plan to the contrary notwithstanding, no term of this Plan relating to ISOs shall be interpreted, amended or altered, nor shall any discretion or authority granted to the Committee under the Plan be exercised, so as to disqualify the Plan or, without the consent of the optionee, any ISO under Section 422 of the Code.

Stock Options granted under the Plan shall be subject to the provisions of Sections 6(a) through Section 6(k) below; SARs shall be subject to the provisions of Section 6(l) below; and Stock Options and SARs shall contain such additional terms and conditions, not inconsistent with the terms of the Plan, as the Committee shall deem desirable:

(a) Option Price. The option price per share of Stock purchasable under a Stock Option shall be determined by the Committee at the time of grant but shall be not less than 100% of Fair Market Value on the date of grant.

-4-

(b) Exercisability. Stock Options shall be exercisable at such time or times, whether or not in installments, as shall be determined by the Committee at or after the grant date. The Committee may at any time accelerate the exercisability of all or any portion of any Stock Option.

(c) Method of Exercise. The person holding a Stock Option may exercise the Stock Option in whole or in part by means of such exercise procedures as the Committee may from time to time establish, each of which shall require, as the Committee determines, delivery to the Committee of the full purchase price plus (as provided in Section 13(d)) any taxes required to be withheld in connection with the exercise, or delivery of an unconditional and irrevocable undertaking by a broker to deliver promptly to the Company sufficient funds to pay such purchase price and taxes, for the portion of Stock Option so exercised. If so permitted by the Committee in its discretion and subject to such limitations and restrictions as the Committee may impose, payment in full or in part of the exercise price or payment of withholding taxes (as provided in Section 13(d)) may also be made in the form of shares of Stock not then subject to restrictions under any Company plan. The person holding a Stock Option shall have the rights of a shareholder only as to shares acquired upon the exercise of a Stock Option and not as to unexercised Stock Options.

(d) Non-transferability of Options. No ISO (and, except as determined by the Committee, no NSO) shall be transferable by the person to whom such Stock Option was granted otherwise than by will or by the laws of descent and distribution, and all ISOs (and, except as determined by the Committee, all NSOs) shall be exercisable during the lifetime of the person to whom such Stock Options were granted only by such person. Transfers, if any, permitted by the Committee in the case of NSOs shall be limited to gratuitous transfers (transfers not for value). Where an NSO is permitted by the Committee to be transferred, references in the Plan to the “person to whom the Stock Option was granted” and similar terms shall be construed, as the Committee in its discretion deems appropriate, to include any permitted transferee to whom the Stock Option is transferred.

(e) Termination by Death. If the employment by the Company and its Subsidiaries of a person to whom a Stock Option was granted terminates by reason of death, the Stock Option may thereafter be exercised, to the extent exercisable immediately prior to death (or on such accelerated or other basis as the Committee shall at any time determine), by the legal representative or legatee of the decedent, for a period of five years (or such shorter period as the Committee shall specify at time of grant) from the date of death or until the expiration of the stated term of the option, if earlier.

(f) Termination by Reason of Disability. If the employment by the Company and its Subsidiaries of a person to whom a Stock Option was granted terminates by reason of Disability, or if such person has been designated an inactive employee by reason of Disability, any Stock Option previously granted to such person may thereafter be exercised to the extent it was exercisable immediatelyday prior to the earlier of such termination or such designation (or on such accelerated or other basis as the Committee shall at any time determine prior to such termination or designation), by the person to whom the Stock Option was granted or, in the event of his or her death following termination, by his or her legal representative or legatee, for a period of five

-5-

years (or such shorter period as the Committee shall specify at time of grant) from the date of such termination of employment or designation or until the expiration of the stated term of the option, if earlier. Except as otherwise provided by the Committee at the time of grant, the death during the final year of such exercise period of the person to whom such Stock Option was granted shall, if such person still holds such Stock Option, extend such period for one year following death or until the expiration of the stated term of the option, if earlier. The Committee shall have the authority to determine whether a Participant has been terminated or designated an inactive employee by reason of Disability and the date of such termination or designation.

(g) Termination by Reason of Normal Retirement. If the employment by the Company and its Subsidiaries of a person to whom a Stock Option has been granted terminates by reason of Normal Retirement, the Stock Option may thereafter be exercised to the extent that it was then exercisable immediately prior to such termination (or on such accelerated or other basis as the Committee shall at any time determine), by the person to whom the Stock Option was granted or, in the event of his or her death following Normal Retirement, by his or her legal representative or legatee, for a period of five years (or such shorter period as the Committee shall specify at time of grant) from the date of Normal Retirement or until the expiration of the stated term of the option, if earlier. Except as otherwise provided by the Committee at the time of grant, the death during the final year of such exercise period of the person to whom such Stock Option was granted shall extend such period for one year following death, subject to termination on the expiration of the stated term of the option, if earlier.

(h) Termination by Reason of Special Service Retirement. If the employment by the Company and its Subsidiaries of a person to whom a Stock Option has been granted terminates by reason of a Special Service Retirement, the Stock Option may thereafter be exercised (to the extent exercisable from time to time during the extended exercise period as hereinafter determined), by the person to whom the Stock Option was granted or, in the event of his or her death following the Special Service Retirement, by his or her legal representative or legatee, for a period of five years (or such shorter period as the Committee shall specify at time of grant) from the date of the Special Service Retirement or until the expiration of the stated term of the option, if earlier. Except as otherwise provided by the Committee at the time of grant, the death during the final year of such exercise period of the person to whom such Stock Option was granted shall extend such period for one year following death or until the expiration of the stated term of the option, if earlier. A Stock Option that is outstanding but not yet fully exercisable at the date of the Special Service Retirement of the person to whom the Stock Option was granted shall continue to become exercisable, over the period of three years following the Special Service Retirement Date (subject to the stated term of the option, or on such accelerated or other basis as the Committee shall at any time determine), on the same basis as if such person had not retired.

(i) Other Termination. If the employment by the Company and its Subsidiaries of a person to whom a Stock Option has been granted terminates for any reason other than death, Disability, Normal Retirement, Special Service Retirement or for Cause, the Stock Option may thereafter be exercised to the extent it was exercisable on the date of termination of employment (or on such accelerated basis as the Committee shall determine at or after grant) for a period of three months (or such other period up to three years as the Committee shall specify at or after

-6-

grant), by the person to whom the Stock Option was granted or, in the event of his or her death following termination, by his or her legal representative or legatee, from the date of termination of employment or until the expiration of the stated term of the option, if earlier. If the employment of such person terminates or is terminated for Cause, the unexercised portion of any Stock Option previously granted to such person shall immediately terminate.

(j) Form of Settlement. Subject to Section 13(a) and Section 13(e) below, shares of Stock issued upon exercise of a Stock Option shall be free of all restrictions under the Plan, except as provided in the following sentence. The Committee may provide at time of grant that the shares to be issued upon the exercise of a Stock Option shall be in the form of Restricted Stock, or may reserve the right to so provide after time of grant.

(k) Discretionary Payments; Automatic Exercise. The Committee may, in its discretion, upon the written request of the person exercising a Stock Option (which request shall not be binding on the Committee, except as hereinafter provided), cancel such Stock Option, whereupon the Company shall pay to the person exercising such Stock Option an amount equal to the excess, if any, of the Fair Market Value of the Stock to have been purchased pursuant to such exercise of such Stock Option (determined on the date the Stock Option is canceled) over the aggregate consideration to have been paid by such person upon such exercise. Such payment shall be by check, bank draft or in Stock (or in another form of payment acceptable both to the Committee and the person exercising the option) having a Fair Market Value (determined on the date the payment is to be made) equal to the amount of such payments or any combination thereof, as determined by the Committee. If a Stock Option remains unexercised on the date it would otherwise have expired and if on such date the Fair Market Value of the shares subject to the Stock Option exceeds the aggregate consideration that would have been required to have been paid to purchase such shares had the Stock Option been exercised, the person then holding the Stock Option shall be deemed to have requested, and the Committee shall be deemed to have approved, a cancellation of such Stock Option in accordance with the first sentence of this Section 6(k) and the amount payable pursuant to the first sentence of this Section 6(k) shall be paid in the form of shares of Stock in accordance with the first sentence of this Section 6(k).

(l) SARs. An SAR is an award entitling the recipient to receive an amount in cash or shares of Stock (or in any other form of payment acceptable to the Committee) or a combination thereof having a value determined by reference to (and not to exceed) the excess of the Fair Market Value of a share of Stock on the date of exercise over the Fair Market Value of a share of Stock on the date of grant (or over the option exercise price, if the SAR was granted in tandem with a Stock Option). The Committee shall determine all terms of SARs granted under the Plan. SARs may be granted in tandem with, or independently of, any Stock Option granted under the Plan. Any SAR granted in tandem with ISOs shall comply with the ISO rules relating to tandem SARs. The Committee may at any time accelerate the exercisability of all or any portion of any SAR.

SECTION 7.OTHER STOCK-BASED AWARDS.

(a) Nature of Stock Awards. Awards under this Section 7 include Awards other than Stock Options or SARs that entitle the recipient to acquire for a purchase price (which may be

-7-

zero) shares of Stock subject to restrictions under the Plan (including a right on the part of the Company during a specified period to repurchase such shares at their original purchase price, or to require forfeiture if the purchase price was zero, upon the Participant’s termination of employment) determined by the Committee (“Restricted Stock”); Awards that entitle the recipient, with or without payment, to the future delivery of shares of Stock, subject to such conditions and restrictions as may be determined by the Committee (“Stock Units”); and other Awards under which Stock may be acquired or which are otherwise based on the value of Stock.

(b) Rights as a Shareholder. A Participant shall have all the rights of a shareholder, including voting and dividend rights, (i) only as to shares of Stock received by the Participant under an Other Stock-based Award, and (ii) in any case, subject to such nontransferability restrictions, Company repurchase or forfeiture rights, and other conditions as are made applicable to the Award.

(c) Restrictions. The Committee may determine the conditions under which an Other Stock-based Award, or Stock acquired under an Other Stock-based Award, shall be forfeited, and may at any time accelerate, waive or, subject to Section 10, amend any or all of such limitations or conditions. Each Other Stock-based Award shall specify the terms on which such Award or the shares under such Award shall vest (become free of restrictions under the Plan), which may include, without limitation, terms that provide for vesting on a specified date or dates, vesting based on the satisfaction of specified performance conditions, and accelerated vesting in the event of termination of employment under specified circumstances. The Committee shall take such steps as it determines to be appropriate to reflect any restrictions applicable to an Other Stock-based Award or the shares thereunder and to facilitate the recovery by the Company of any such Award or shares that are forfeited.

Notwithstanding the foregoing, no grants of Full Value Awards, other than grants made in connection with a Participant’s commencement of employment with the Company or any Subsidiary, shall specify a vesting date that is less than three years from the date of grant except as follows: (i) the vesting date may be one year (or a greater period) from the date of grant in the case of a Full Value Award subject to the attainment of performance goals, (ii) Full Value Awards may be granted which specify full vesting in no less than three years and partial vesting at a rate no faster than one-third of such shares each year, (iii) Full Value Awards may provide for accelerated vesting in the event of death, disability, retirement or a Change of Control, and (iv) Full Value Awards may be granted without regard to the foregoing limitations provided that the maximum number of shares subject to such Awards granted after the Adoption Date, when no longer subject to restrictions under the Plan, does not exceed 3,000,000 shares.

Except as otherwise determined by the Committee, (A) neither any Other Stock-based Award nor any unvested Restricted Stock acquired under an Other Stock-based Award may be sold, assigned, transferred, pledged or otherwise encumbered or disposed of except as specifically provided herein, and (B) in the event of termination of employment with the Company and its Subsidiaries for any reason, any shares of Restricted Stock that are not then vested (taking into account any accelerated vesting applicable to such shares under the terms of the Award or otherwise) shall be resold to the Company at their purchase price or forfeited to the Company if the purchase price was zero. The Committee at any time may accelerate the vesting

-8-

date or dates for an Other Stock-based Award or for Restricted Stock, if any, granted thereunder and may otherwise waive or, subject to Section 10, amend any conditions of the Award. Neither the Committee nor the Company shall be liable for any adverse tax or other consequences to a Participant from any such acceleration, waiver, or amendment.

(d) Dividends; Dividend Equivalents. Except as otherwise determined by the Committee, a Participant’s rights under an Other Stock-based Award to dividends (or dividend equivalent payments, in the case of an Other Stock-based Award, if any, other than Restricted Stock, that is subject to vesting conditions and as to which the Committee has made provision for such payments) shall be treated as unvested so long as such Award remains unvested (the “restricted period”), and any such dividends or dividend equivalent payments that would otherwise have been paid during the restricted period shall instead be accumulated and paid within thirty (30) days following the date on which such Award is determined by the Company to have vested.

(e) Annual Deferred Stock Awards, Additional Deferred Stock Awards and Dividend Awards for Eligible Directors.

| (i) | | | |

The TJX Companies, Inc. | | Accounts. The Company shall establish and maintain an Account | | INTERNET http://www.proxyvoting.com/tjx Use the Internet to vote your proxy. Have your proxy card in hand when you access the name of each Eligible Director to which the Annual Deferred Stock Awards, Additional Deferred Stock Awards and Dividend Awards shall be credited. |

| web site. |

| | (ii) | | Annual Awards. On the date of each Annual Meeting, each Eligible Director who is elected a Director at such Annual Meeting shall automatically and without further action by the Board or Committee be granted an Annual Deferred Stock Award as provided in subsection (iv) and an Additional Deferred Stock Award as provided in subsection (v). On each date other than the date of an Annual Meeting on which an Eligible Director is first elected a Director by the Board, the Eligible Director then so elected shall automatically and without further action by the Board or Committee be granted a prorated Annual Deferred Stock Award as provided in subsection (iv) and a prorated Additional Deferred Stock Award as provided in subsection (v). The grant of each Annual Deferred Stock Award and Additional Deferred Stock Award shall entitle each recipient, automatically and without further action by the Board or the Committee, to Dividend Awards as provided in subsection (vi). |

OR |

| | (iii) | | Nature of Awards. Each Annual Deferred Stock Award, Additional Deferred Stock Award and Dividend Award shall be an Other Stock-based Award subjectTELEPHONE 1-866-540-5760 Use any touch-tone telephone to the terms of this Plan and shall constitute an unfunded and unsecured promise of the Company to delivervote your proxy. Have your proxy card in the future to such Eligible Director, without payment, the number of shares of Stock in the amounts and at the times hereinafter provided. The shares of Stock notionally credited to the Accounts of Eligible Directors shall be notional shares only and shall not entitle the Eligible Director to any voting rights, dividend or distribution or other rights except as expressly set forth herein. Nothing herein shall obligate the Company to issue or set aside shares of Stock, in trust or otherwise, to meet its contractual obligations hereunder. |

-9-hand when you call.

| (iv) | | Annual Deferred Stock Award. In respect of each Annual Deferred Stock Award granted on the date of an Annual Meeting, the Company shall credit to each Eligible Director’s Account, effective as of the date of such Annual Meeting, the number of notional shares of Stock, including any fractional share, equal to $100,000 or such lesser dollar amount as may be determined by the Board divided by the Fair Market Value of a share of Stock on the date of such Annual Meeting. In respect of each Annual Deferred Stock Award granted on a date other than the date of an Annual Meeting, the Company shall credit to the Account of the Eligible Director first elected on such date the number of notional shares of Stock, including any fractional share, equal to (i) $100,000 or such lesser dollar amount as may be determined by the Board divided by the Fair Market Value of a share of Stock on the date of such first election multiplied by (ii) the quotient (not greater than one) obtained by dividing (A) the number of days starting with the date of such first election and ending on the day first preceding the anticipated date of the next Annual Meeting, by (B) 365. |

|

| | (v) | | Additional Deferred Stock Award. In additionIf you vote your proxy by Internet or by telephone, you do NOT need to mail back your proxy card. |

| | | | To vote by mail, mark, sign and date your proxy card and return it in the Annual Deferred Stock Award,enclosed postage-paid envelope. |

| | | | Your Internet or telephone vote authorizes the Company shall creditnamed proxies to the Account of each Eligible Director, effective as of the date that any Annual Deferred Stock Award is credited to such Account, an Additional Deferred Stock Award covering the same number ofvote your shares as are covered by such Annual Deferred Stock Award determined in the same manner prescribed in subsection (iv) above.as if you marked, signed and returned your proxy card. |

|

| (vi) | | Dividend Awards. The Company shall credit (each such credit, a “Dividend Award”) the Account of each Eligible Director on the date of each Annual Meeting and on the date on which an Eligible Director ceases to be a Director if not the date of an Annual Meeting with a number of notional shares of Stock, including any fractional share, equal to (i) plus (ii), divided by (iii), where: | |

| (i) | |

WO# 22569 | | is the product obtained by multiplying the number of shares then allocated to such Eligible Director’s Account (disregarding, for purposes of this clause (i), any shares credited to such Account since the date of the immediately preceding Annual Meeting) by the aggregate per-share amount of dividends for which the record date occurred since the date of the immediately preceding Annual Meeting; |

q FOLD AND DETACH HEREq

| | | | |

|

| (ii)Please vote, date and sign below and return promptly in the enclosed envelope. | | is the product obtained by multiplying the number of shares first credited to such Eligible Director’s Account since the date of the immediately preceding Annual Meeting but prior to the date of such Dividend Award by the aggregate per-share amount of dividends for which the record date occurred since the date that such shares were credited to such Account; and |

-10-

Please mark your votes as

indicated in this example

| (iii) | | is the Fair Market Value of one share of Stock on the date of such Dividend Award. |

| (vii) | | Vesting. Each Annual Deferred Stock Award, and any Dividend Awards in respect of Annual Deferred Stock Awards and/or Additional Deferred Stock Awards, shall vest immediately upon grant and be non-forfeitable. Each Additional Deferred Stock Award shall vest and become non-forfeitable on the date immediately preceding the date of the Annual Meeting next succeeding the date of grant of such Award;provided, that the recipient is still a Director on such date. In the event that an Eligible Director terminates his or her service as a Director for any reason prior to such vesting date, the Eligible Director shall forfeit any then unvested Additional Deferred Stock Award.x |

|

| (viii) | | Delivery. The Company shall deliver to an Eligible Director (or a former Eligible Director) the number of shares of Stock, rounded up to the next full share, represented by notional shares of Stock credited to the Account of such Eligible Director in respect of Annual Deferred Stock Awards (including any Dividend Awards made in respect of such Annual Deferred Stock Awards) at the earlier of the following: (x) immediately prior to a Change of Control or (y) within sixty (60) days following the Eligible Director’s death or earlier separation from service (as determined under the regulations under Section 409A of the Code). With respect to any Additional Deferred Stock Award, absent an election to defer delivery of the shares of Stock subject to such Award pursuant to subsection (ix) below, the Company shall deliver to an Eligible Director the number of shares of Stock, rounded up to the next full share, represented by notional shares of Stock credited to the Account of such Eligible Director in respect of such Additional Deferred Stock Award (including any Dividend Awards made in respect of such Additional Deferred Stock Award) at the earlier of the following: (x) immediately prior to a Change of Control or (y) within sixty (60) days following the date of vesting pursuant to subsection (vii) above. In the event of a termination by reason of death, such shares of Stock shall be delivered to such beneficiary or beneficiaries designated by the Eligible Director in writing in such form, and delivered prior to his or her death to such person at the Company, as specified by the Company or, in the absence of such a designation, to the legal representative of Eligible Director’s estate. |

|

| (ix) | | Deferral of Delivery of Additional Deferred Stock Awards. By filing a written notice to the Company in such form, and delivered to such person at the Company, as specified by the Company, an Eligible Director may irrevocably elect to defer receipt of the delivery of shares of Stock representing all or a portion of the notional shares of Stock subject to any Additional Deferred Stock Award (including any Dividend Awards made in respect of such notional shares) until the earlier of the following: (x) immediately prior to a Change of Control or (y) as soon as practicable and in all events within sixty (60) days following the |

-11-

| | | Eligible Director’s death or earlier separation from service (as determined under the regulations under Section 409A of the Code). Any election made pursuant to this subsection (ix) must be submitted with respect to any Additional Deferred Stock Award (A) in the case of the Additional Deferred Stock Award granted on the date an Eligible Director is first elected as a Director, no later than 30 days after the date of such Eligible Director’s election to the Board or (B) in the case of any other Additional Deferred Stock Award, no later than December 31 of the calendar year preceding the calendar year in which such Award is granted, or (C) at such other time as is necessary to satisfy the requirements of Section 409A of the Code, as determined by the Committee. |

SECTION 8.PERFORMANCE AWARDS.

(a) Nature of Performance Awards. A Performance Award is an award entitling the recipient to acquire cash or shares of Stock, or a combination of cash and Stock, upon the attainment of specified performance goals. If the grant, vesting, or exercisability of a Stock Option, SAR, or Other Stock-Based Award is conditioned upon attainment of a specified performance goal or goals, it shall be treated as a Performance Award for purposes of this Section and shall be subject to the provisions of this Section in addition to the provisions of the Plan applicable to such form of Award.

(b) Qualifying and Nonqualifying Performance Awards. Performance Awards may include Awards intended to qualify for the performance-based compensation exception under Section 162(m)(4)(C) of the Code (“Qualifying Awards”) and Awards not intended so to qualify (“Nonqualifying Awards”).

(c) Terms of Performance Awards. The Committee in its sole discretion shall determine the performance goals applicable under each such Award, the periods during which performance is to be measured, and all other limitations and conditions applicable to the Award. Performance Awards may be granted independently or in connection with the granting of other Awards. In the case of a Qualifying Award (other than a Stock Option), the following special rules shall apply: (i) the Committee shall preestablish the performance goals and other material terms of the Award not later than the latest date permitted under Section 162(m) of the Code; (ii) the performance goal or goals fixed by the Committee in connection with the Award shall be based exclusively on one or more Approved Performance Criteria; (iii) no payment (including, for this purpose, vesting or exercisability where vesting or exercisability, rather than the grant of the Award, is linked to satisfaction of performance goals) shall be made unless the preestablished performance goals have been satisfied and the Committee has certified (pursuant to Section 162(m) of the Code) that they have been satisfied; (iv) no payment shall be made in lieu or in substitution for the Award if the preestablished performance goals are not satisfied (but this clause shall not limit the ability of the Committee or the Company to provide other remuneration to the affected Participant, whether or not under the Plan, so long as the payment of such remuneration would not cause the Award to fail to be treated as having been contingent on the preestablished performance goals) and (v) in all other respects the Award shall be construed and administered consistent with the intent that any compensation under the Award be treated as performance-based compensation under Section 162(m)(4)(C) of the Code.

-12-

(d) Rights as a Shareholder. A Participant shall have all the rights of a shareholder, including voting and dividend rights, (i) only as to shares of Stock received by the Participant under a Performance Award, and (ii) in any case, subject to such nontransferability restrictions, Company repurchase or forfeiture rights, and other conditions as are made applicable to the Award. Notwithstanding the foregoing and for the avoidance of doubt, in the case of any Performance Award that is also an Other Stock-based Award, the limitations of Section 7(d) (providing that rights to dividends and dividend equivalents shall remain unvested until the underlying Stock or rights to Stock are vested) shall apply to any right to dividends or dividend equivalent payments hereunder.

(e) Termination. Except as may otherwise be provided by the Committee (consistent with Section 162(m) of the Code, in the case of a Qualifying Award), a Participant’s rights in all Performance Awards shall automatically terminate upon the Participant’s termination of employment by the Company and its Subsidiaries for any reason (including death).

(f) Acceleration, Waiver,etc.. The Committee may in its sole discretion (but subject to Section 162(m) of the Code, in the case of a Qualifying Award) accelerate, waive or, subject to Section 10, amend any or all of the goals, restrictions or conditions imposed under any Performance Award. Neither the Committee nor the Company shall be liable for any adverse tax or other consequences to a Participant from any such acceleration, waiver, or amendment.

SECTION 9.TRANSFER, LEAVE OF ABSENCE.

For purposes of the Plan, the following events shall not be deemed a termination of employment:

| (a) | | a transfer to the employment of the Company from a Subsidiary or from the Company to a Subsidiary, or from one Subsidiary to another; |

|

| (b) | | an approved leave of absence for military service or sickness, or for any other purpose approved by the Company, but in each case only if the employee’s right to reemployment is guaranteed either by a statute or by contract or under the policy pursuant to which the leave of absence was granted or if the Committee otherwise so provides in writing. |

For purposes of the Plan, the employees of a Subsidiary of the Company shall be deemed to have terminated their employment on the date on which such Subsidiary ceases to be a Subsidiary of the Company. Subject to the foregoing, an individual’s employment with the Company and its Subsidiaries shall be considered to have terminated on the last day of his or her actual employment, whether such day is determined by agreement between the Company or a Subsidiary and the individual or unilaterally, and whether such termination is with or without notice, and no period of advance notice, if any, that is or ought to have been given under applicable law in respect of such termination of employment shall be taken into account in determining the individual’s entitlements, if any, under the Plan or any Award.

-13-

Notwithstanding the foregoing, in the case of any Award that is subject to the requirements of Section 409A of the Code, “termination of employment” shall mean a separation from service (as determined under the regulations under Section 409A of the Code).

SECTION 10.AMENDMENTS AND TERMINATION.

The Board or the Committee may at any time amend or discontinue the Plan and the Committee may at any time amend or cancel any outstanding Award for the purpose of satisfying changes in law or for any other lawful purpose, but no such action shall materially adversely affect rights under any outstanding Award without the holder’s consent. However, no such amendment shall be effective unless approved by stockholders if it would (i) reduce the exercise price of any option previously granted hereunder or otherwise constitute a repricing requiring stockholder approval under applicable New York Stock Exchange rules, or (ii) effect a change which, in the determination of the Committee, would jeopardize the qualification of an Award that the Committee has determined is intended to qualify (and to continue to qualify) as an ISO or as exempt performance-based compensation under Section 162(m) of the Code. Notwithstanding any provision of this Plan, the Board or the Committee may at any time adopt any subplan or otherwise grant Stock Options or other Awards under this Plan having terms consistent with applicable foreign tax or other foreign regulatory requirements or laws.

SECTION 11.STATUS OF PLAN.

With respect to the portion of any Award which has not been exercised and any payments in cash, stock or other consideration not received by a Participant, a Participant shall have no rights greater than those of a general creditor of the Company unless the Committee shall otherwise expressly determine in connection with any Award or Awards. In its sole discretion, the Committee may authorize the creation of trusts or other arrangements to meet the Company’s obligations to deliver Stock or make payments with respect to awards hereunder, provided that the existence of such trusts or other arrangements is consistent with the provision of the foregoing sentence.

SECTION 12.CHANGE OF CONTROL PROVISIONS.

As used herein, a Change of Control and related definitions shall have the meanings set forth in Exhibit A to this Plan.

Upon the occurrence of a Change of Control:

| (i) | | Each Stock Option shall automatically become fully exercisable unless the Committee shall otherwise expressly provide at the time of grant. |

| (ii) | | Restrictions and conditions on Other Stock-based Awards (including without limitation Restricted Stock) and Performance Awards shall automatically be deemed waived unless the Committee shall otherwise expressly provide at the time of grant. |

-14-

The Committee may at any time prior to or after a Change of Control accelerate the exercisability of any Stock Options and may waive restrictions, limitations and conditions on Other Stock-based Awards (including without limitation Restricted Stock) and Performance Awards to the extent it shall in its sole discretion determine.

SECTION 13.GENERAL PROVISIONS.

(a) No Distribution; Compliance with Legal Requirements, etc. The Committee may require each person acquiring shares pursuant to an Award to represent to and agree with the Company in writing that such person is acquiring the shares without a view to distribution thereof. No shares of Stock shall be issued pursuant to an Award until all applicable securities law and other legal and stock exchange requirements have been satisfied. The Committee may require the placing of such stop-orders and restrictive legends on certificates for Stock and Awards as it deems appropriate.

(b) References to Employment. Wherever reference is made herein to “employee,” “employment” (or correlative terms), except in Section 4, the term shall be deemed to include both common law employees and others.

(c) Other Compensation Arrangements; No Employment Rights. Nothing contained in this Plan shall prevent the Board of Directors from adopting other or additional compensation arrangements, subject to stockholder approval if such approval is required; and such arrangements may be either generally applicable or applicable only in specific cases. The adoption of the Plan does not confer upon any employee any right to continued employment with the Company or a Subsidiary, nor does it interfere in any way with the right of the Company or a Subsidiary to terminate the employment of any of its employees at any time.

(d) Tax Withholding, etc. Each Participant shall, no later than the date as of which the value of an Award or of any Stock or other amounts received thereunder first becomes includable in the gross income of the Participant for Federal income tax purposes, pay to the Company, or make arrangements satisfactory to the Committee regarding payment of, any Federal, state, or local taxes of any kind required by law to be withheld with respect to such income. The Company and its Subsidiaries shall, to the extent permitted by law, have the right to deduct any such taxes from any payment of any kind otherwise due to the Participant. The Company may withhold or otherwise administer the Plan to comply with tax obligations under any applicable foreign laws.

The Committee may provide, in respect of any transfer of Stock under an Award, that if and to the extent withholding of any Federal, state or local tax is required in respect of such transfer or vesting, the Participant may elect, at such time and in such manner as the Committee shall prescribe, to (i) surrender to the Company Stock not then subject to restrictions under any Company plan or (ii) have the Company hold back from the transfer or vesting Stock having a value calculated to satisfy such withholding obligation. In no event shall Stock be surrendered under clause (i) or held back by the Company under clause (ii) in excess of the minimum amount required to be withheld for Federal, state and local taxes.

-15-

Except as otherwise expressly provided by the Committee in any case, all Awards under the Plan that are not exempt from the requirements of Section 409A of the Code shall be construed to comply with the requirements of Section 409A of the Code and any discretionary authority of the Committee or the Company with respect to an Award that is intended to be exempt from or in compliance with the requirements of Section 409A of the Code shall be exercised in a manner that is consistent with such intent. Notwithstanding the foregoing, neither the Company nor any Subsidiary, nor any officer, director or employee of the Company or any Subsidiary, nor the Board or the Committee or any member of either, shall be liable to the Participant or any beneficiary of a Participant by reason of any additional tax (whether or not under Section 409A of the Code), including any interest or penalty, resulting from any exercise of discretion or other action or failure to act by any of the Company, any Subsidiary, any such officer, director or employee, or the Board or the Committee, or by reason of the failure of an Award to qualify for an exemption from, or to comply with the requirements of, Section 409A of the Code, or for any cost or expense incurred in connection with any action by any taxing authority related to any of the foregoing.

(e) Deferral of Awards. Participants may elect to defer receipt of Awards or vesting of Awards only in such cases and to the extent that the Committee shall determine at or after the grant date.

SECTION 14.DEFINITIONS.

The following terms shall be defined as set forth below:

(a) “Account” means a bookkeeping account established and maintained under Section 7(e) in the name of each Eligible Director to which Annual Deferred Stock Awards, Additional Deferred Stock Awards, and Dividend Awards are credited hereunder.

(b) “Act” means the Securities Exchange Act of 1934.

(c) “Additional Deferred Stock Award” means an Award granted to an Eligible Director pursuant to Section 7(e)(v).

(d) “Adoption Date” is defined in Section 1.

(e) “Annual Deferred Stock Award” means an Award granted to an Eligible Director pursuant to Section 7(e)(iv).

(f) “Annual Meeting” shall mean the annual meeting of stockholders of the Company.

(g) “Approved Performance Criteria” means criteria based on any one or more of the following (on a consolidated, divisional, line of business, geographical or area of executive’s responsibilities basis): one or more items of or within (i) sales, revenues, assets or expenses; (ii) earnings, income or margins, before or after deduction for all or any portion of interest, taxes, depreciation, or amortization, whether or not on a

-16-

continuing operations, or aggregate or per share basis; (iii) return on investment, capital, assets, sales or revenues; and (iv) stock price; in each case with such inclusions thereto or exclusions therefrom as the Committee may determine in a manner consistent with Section 162(m) of the Code. In determining whether a performance goal based on one or more Approved Performance Criteria has been satisfied for any period, any extraordinary item, change in generally accepted accounting principles, or change in law (including regulations) that would affect the determination as to whether such performance goal had been achieved will automatically be disregarded or taken into account, whichever would cause such performance goal to be more likely to be achieved, and to the extent consistent with Section 162(m) of the Code the Committee may provide for other objectively determinable and nondiscretionary adjustments; provided, that nothing herein shall be construed as limiting the Committee’s authority to reduce or eliminate a Performance Award (including, without limitation, by restricting vesting under any such Award) that would otherwise be deemed to have been earned.

(h) “Award” or “Awards” except where referring to a particular category of grant under the Plan shall include Stock Options, SARs, Other Stock-based Awards and Performance Awards.

(i) “Board” means the Board of Directors of the Company.

(j) “Cause” means (i) as to any Participant who at the relevant time is party to an employment, severance, or similar agreement with the Company or a Subsidiary that contains a definition of “cause” (including any similar term used in connection with a for-cause involuntary termination), the definition set forth in such agreement, and (ii) in every other case, a felony conviction of a Participant or the failure of a Participant to contest prosecution for a felony, or a Participant’s willful misconduct or dishonesty, any of which is directly harmful to the business or reputation of the Company or any Subsidiary.

(k) “Code” means the Internal Revenue Code of 1986, as amended, and any successor Code, and related rules, regulations and interpretations.

(l) “Committee” means the Committee referred to in Section 2.

(m) “Company” means The TJX Companies, Inc.

(n) “Director” means a member of the Board.

(o) “Disability” means disability as determined in accordance with standards and procedures similar to those used under the Company’s long term disability program.

(p) “Dividend Award” means an Award granted to an Eligible Director pursuant to Section 7(e)(vi).

(q) “Eligible Director” means a Director who is not employed (other than as a Director) by the Company or by any Subsidiary.

-17-

(r) “Fair Market Value” on any given date means the last sale price regular way at which Stock is traded on such date as reflected in the New York Stock Exchange Composite Transactions Index or, where applicable, the value of a share of Stock as determined by the Committee in accordance with the applicable provisions of the Code.

(s) “Full Value Award” means an Award other than a Stock Option or an SAR.

(t) “ISO” means a Stock Option intended to be and designated as an “incentive stock option” as defined in the Code.

(u) “Non-Employee Director” shall have the meaning set forth in Rule 16b-3(b)(3) promulgated under the Act, or any successor definition under the Act.

(v) “NSO” means any Stock Option that is not an ISO.

(w) “Normal Retirement” means retirement from active employment with the Company and its Subsidiaries at or after age 65 with at least five years of service for the Company and its Subsidiaries as specified in The TJX Companies, Inc. Retirement Plan.

(x) “Other Stock-based Award” means an Award of one of the types described in Section 7.

(y) “Outside Director” means a member of the Board who is treated as an “outside director” for purposes of Section 162(m) of the Code.

(z) “Participant” means a participant in the Plan.

(aa) “Performance Award” means an Award described in Section 8.

(bb) “Plan” is defined in Section 1.

(cc) “Restricted Stock” is defined in Section 7(a).

(dd) “SAR” means an Award described in Section 6(l).

(ee) “Stock Unit” is defined in Section 7(a).

(ff) “Share Limit” is defined in Section 3(a).

(gg) “Special Service Retirement” means retirement from active employment with the Company and its Subsidiaries (i) at or after age 60 with at least twenty years of service for the Company and its Subsidiaries, or (ii) at or after age 65 with at least ten years of service for the Company and its Subsidiaries.

(hh) “Stock” means the Common Stock, $1.00 par value, of the Company, subject to adjustments pursuant to Section 3.

-18-

(ii) “Stock Option” means any option to purchase shares of Stock granted pursuant to Section 6.

(jj) “Subsidiary” means any corporation or other entity (other than the Company) in an unbroken chain beginning with the Company if each of the entities (other than the last entity in the unbroken chain) owns stock or other interests possessing 50% or more of the total combined voting power of all classes of stock or other interest in one of the other corporations or other entities in the chain.

-19-

EXHIBIT A

DEFINITION OF “CHANGE OF CONTROL”

“Change of Control” shall mean the occurrence of any one of the following events:

(a) there occurs a change of control of the Company of a nature that would be required to be reported in response to Item 5.01 of the Current Report on Form 8-K (as amended in 2004) pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) or in any other filing under the Exchange Act;provided,however, that if the Participant or a Participant Related Party is the Person or a member of a group constituting the Person acquiring control, a transaction shall not be deemed to be a Change of Control as to a Participant unless the Committee shall otherwise determine prior to such occurrence; or

(b) any Person other than the Company, any wholly-owned subsidiary of the Company, or any employee benefit plan of the Company or such a subsidiary becomes the owner of 20% or more of the Company’s Common Stock and thereafter individuals who were not directors of the Company prior to the date such Person became a 20% owner are elected as directors pursuant to an arrangement or understanding with, or upon the request of or nomination by, such Person and constitute a majority of the Company’s Board of Directors;provided,however, that unless the Committee shall otherwise determine prior to the acquisition of such 20% ownership, such acquisition of ownership shall not constitute a Change of Control as to a Participant if the Participant or a Participant Related Party is the Person or a member of a group constituting the Person acquiring such ownership; or

(c) there occurs any solicitation or series of solicitations of proxies by or on behalf of any Person other than the Company’s Board of Directors and thereafter individuals who were not directors of the Company prior to the commencement of such solicitation or series of solicitations are elected as directors pursuant to an arrangement or understanding with, or upon the request of or nomination by, such Person and constitute a majority of the Company’s Board of Directors; or

(d) the Company executes an agreement of acquisition, merger or consolidation which contemplates that (i) after the effective date provided for in such agreement, all or substantially all of the business and/or assets of the Company shall be owned, leased or otherwise controlled by another Person and (ii) individuals who are directors of the Company when such agreement is executed shall not constitute a majority of the board of directors of the survivor or successor entity immediately after the effective date provided for in such agreement;provided,however, that unless otherwise determined by the Committee, no transaction shall constitute a Change of Control as to a Participant if, immediately after such transaction, the Participant or any Participant Related Party shall own equity securities of any surviving corporation (“Surviving Entity”) having a fair value as a percentage of the fair value of the equity securities of such Surviving Entity

-20-

greater than 125% of the fair value of the equity securities of the Company owned by the Participant and any Participant Related Party immediately prior to such transaction, expressed as a percentage of the fair value of all equity securities of the Company immediately prior to such transaction (for purposes of this paragraph ownership of equity securities shall be determined in the same manner as ownership of Common Stock); andprovided,further, that, for purposes of this paragraph (d), if such agreement requires as a condition precedent approval by the Company’s shareholders of the agreement or transaction, a Change of Control shall not be deemed to have taken place unless and until the acquisition, merger, or consolidation contemplated by such agreement is consummated (but immediately prior to the consummation of such acquisition, merger, or consolidation, a Change of Control shall be deemed to have occurred on the date of execution of such agreement).

In addition, for purposes of this Exhibit A the following terms have the meanings set forth below:

“Common Stock” shall mean the then outstanding Common Stock of the Company plus, for purposes of determining the stock ownership of any Person, the number of unissued shares of Common Stock which such Person has the right to acquire (whether such right is exercisable immediately or only after the passage of time) upon the exercise of conversion rights, exchange rights, warrants or options or otherwise. Notwithstanding the foregoing, the term Common Stock shall not include shares of Preferred Stock or convertible debt or options or warrants to acquire shares of Common Stock (including any shares of Common Stock issued or issuable upon the conversion or exercise thereof) to the extent that the Board of Directors of the Company shall expressly so determine in any future transaction or transactions.

A Person shall be deemed to be the “owner” of any Common Stock:

(i) of which such Person would be the “beneficial owner,” as such term is defined in Rule 13d-3 promulgated by the Securities and Exchange Commission (the “Commission”) under the Exchange Act, as in effect on March 1, 1989; or

(ii) of which such Person would be the “beneficial owner” for purposes of Section 16 of the Exchange Act and the rules of the Commission promulgated thereunder, as in effect on March 1, 1989; or

(iii) which such Person or any of its affiliates or associates (as such terms are defined in Rule 12b-2 promulgated by the Commission under the Exchange Act, as in effect on March 1, 1989) has the right to acquire (whether such right is exercisable immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding or upon the exercise of conversion rights, exchange rights, warrants or options or otherwise.

“Person” shall have the meaning used in Section 13(d) of the Exchange Act, as in effect on March 1, 1989.

-21-

A “Participant Related Party” shall mean, with respect to a Participant, any affiliate or associate of the Participant other than the Company or a Subsidiary of the Company. The terms “affiliate” and “associate” shall have the meanings ascribed thereto in Rule 12b-2 under the Exchange Act (the term “registrant” in the definition of “associate” meaning, in this case, the Company).

Notwithstanding the foregoing, in any case where the occurrence of a Change of Control could affect the vesting of or payment under an Award subject to the requirements of Section 409A of the Code, the term “Change of Control” shall mean an occurrence that both (i) satisfies the requirements set forth above in this Exhibit A, and (ii) is a “change in control event” as that term is defined in the regulations under Section 409A of the Code.

-22-

Please Vote, Date and Sign Below and Return Promptly in the Enclosed Envelope.

| | |

Please mark

your votes as

indicated in

this example | | x |

| | | | | | | | | | |

| | | | | | FOR all | | WITHHOLD | | |

| | | | | | nominees | | AUTHORITY to vote | | |

| The Board of Directors recommends a | | listed below | | for all nominees | | EXCEPTIONS* |

vote FOR the Election of Directors. | | | | listed belowfollowing Director nominees in Proposal 1. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

1. Election of Directors | | | | | | | | | | |

1. | | Election of Directors | | c | | c | | c |

| | Nominees: | | | | |

| Nominees: | | FOR | | |

AGAINST | | (01) José B. AlvarezABSTAIN | | (05) David T. Ching | (09) John F. O’Brien |

| | (02) Alan M. Bennett FOR | | (06)AGAINST | | ABSTAIN | | | | | | | | | | |

1.1 Zein Abdalla | | ¨ | | ¨ | | ¨ | | 1.6 Michael F. Hines | (10) Robert F. Shapiro |

| ¨ | | (03) David A. Brandon¨ | | (07) Amy B. Lane | (11) Willow B. Shire |

| ¨ | | (04) Bernard Cammarata | | (08) Carol Meyrowitz | (12) Fletcher H. Wiley |

| |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the “Exceptions” box and write that nominee’s name in the space provided below.)

|

| | | | | | | | | | |

*Exceptions |

| | | | | | | | |

| | | | | | | | |

The Board of Directors recommends a vote FOR Proposal 2. | | FOR | | AGAINST | | ABSTAIN |

| | | | | | | | | | | | |

| 1.2 José B. Alvarez | | ¨ | | ¨ | | ¨ | | 1.7 Amy B. Lane | | ¨ | | ¨ | | ¨ | | 2. | | Ratification of appointment of independent registered public accounting firm. | | ¨ | | ¨ | | ¨ |